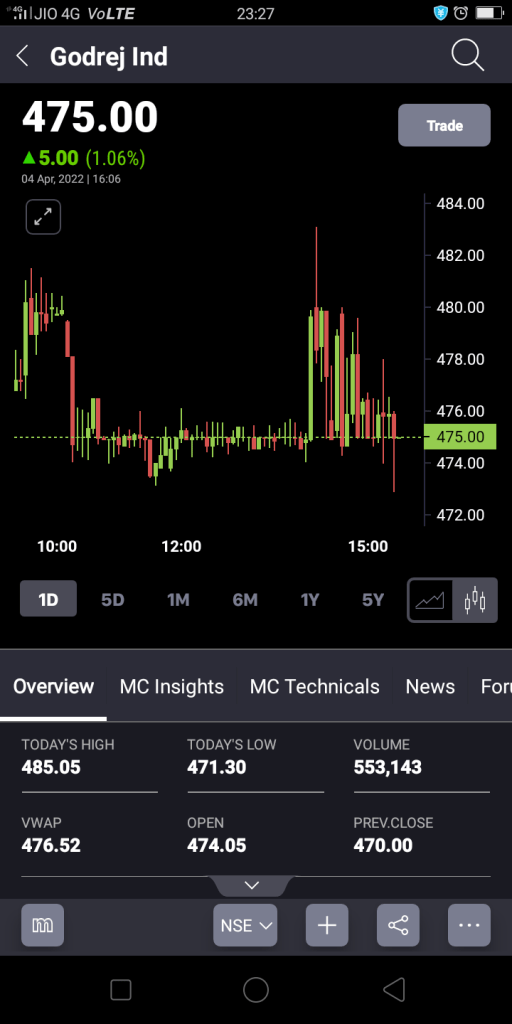

The Most Overvalued Company Is Now GodrejIndustries.

52 Week Low is 426 whereas 52 Week High is 662.

Beta is 0.58, means less Volatility.

Market Capitalisation is 15,530 Crore.

Company P/E is 37.82 whereas Industrial P/E is 57.75.

Increasing Revenue Every 4 Quarters.

Negative Breakdown Occurred, But Share Will Bounce Back.

This is due to Big 1% Buyout From Inside The Company.

Financial Profile:-

According To Revenue, when compared with 2020, Revenue decreased to 9333Crore from 11290Crore.

Net Profit had fallen down from 373Crore to 37Crore.

EPS has come down sharply from 16.41 to 9.94.

Enterprise value had been increased sharply from 277 to 397 respectively.

ROE is 4.47, which is below the standard of 14, which is an acceptable figure.

Debt To Equity has gone up from 1.15 to 1.20.

1 Month Performance is -11%. 3 Months Performance is -27%. 1 Year Performance is -13, whereas 3 Years Performance is near to -14.

Sales of GodrejIndustries has increased from 3280Crore to 3514Crores.

Gross Profit has been increased from 323Crore to 325Crore.

Net Profit has come down from 115Crore to 111Crore.

Reserves has been increased from 5743Croee to 7511Crore.

Operating Activities and Investing Activities is right now on Negative Side.

Net Cash Flow has improved from -132Crors to -47Crore.

EPS is 9.94. Book Value has increased from 277 to 397/share.

Gross Profit Margin is 10.44, Operating Margin is 7.84, and Net Profit Margin is 0.41.

Current Ratio is 1.46, Quick Ratio is 0.94.

Debt to Equity is 1.29 is on the higher side.

3 Year CAGR is -48.70.

EV/EBiTDA has increased from 13.58 to 33.84.

Click Below To Get Free Shares :-

Leave a comment